National Conversations on Medical Debt with Local Repercussions

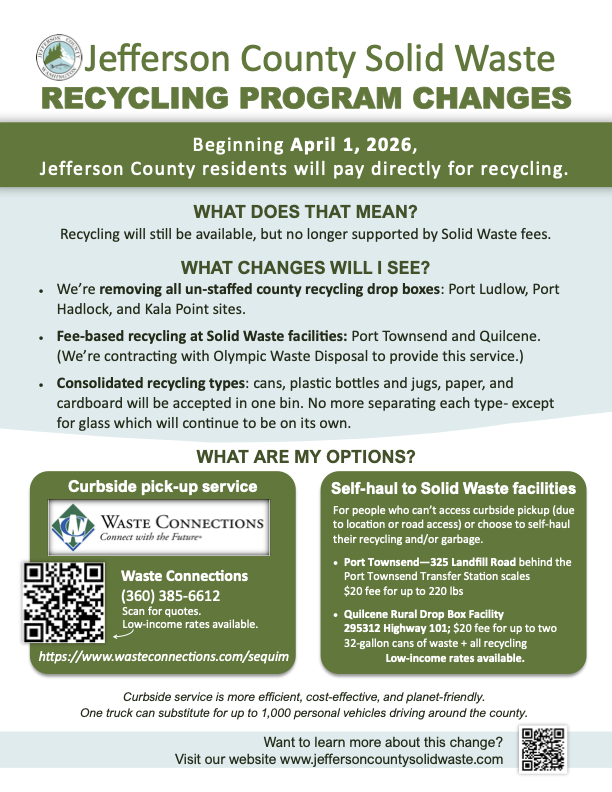

[caption id align="alignnone" width="1236"]

Image: Airlift Northwest Helicopter N951AL at Harborview . Licensed under CC BY-SA 2.0 . [/caption]

News Analysis By Sara Post

A woman is shuffling through papers in her bag as she sits beside her family member in the hospital gurney, looking for something to show me. “You want to see something hilarious? Check this out.” She finds what she’s looking for and holds it up: an air ambulance bill for $42,000.

In September of 2024, her family member was airlifted from the site of a motor vehicle crash in Quilcene to Harborview Hospital, where he stayed for three weeks and returned to a mountain of challenges - wound care, pain, follow-up appointments - and bills.

Because there are no trauma hospitals on the Olympic Peninsula, severe motor vehicle crash patients are airlifted to Seattle. Airlift Northwest and Life Flight Network - Jefferson County’s only air ambulance options - are not covered by public insurance. And hospitals which helicopters fly to may or may not be “in-network” with an individual’s insurance.

“Good news: on January 7, 2025, the Consumer Financial Protection Bureau (CFPB) announced that unpaid medical bills will soon no longer appear on credit reports. The bureau predicts the removal of $49 million in medical debt from 15 million Americans. ”

More often than not, people turn to private fundraising to recoup costs from medical treatment. A 2021 study published by the American Public Health Association reported that GoFundMe campaigns for medical bills raised over $2 million from 21.7 million donations between 2016-2020, despite only 12% of campaigns meeting their goals. Locally, several medical GoFundMes have emerged on Jefferson County Facebook groups in the past month.

In December 2024, the shooting of the United Healthcare CEO brought collective anger at the rising cost of care to the surface. A legal fundraiser for the suspected assailant has, as of this week, raised over $223,000. Comments by donors on the website recount experiences of being denied financial coverage for costly life-saving treatments or of being billed afterward beyond the ability to pay.

These donors are not alone – over half of collection entries on credit reports are for medical debt, representing one in five Americans. But in good news: on January 7, 2025, the Consumer Financial Protection Bureau (CFPB) announced that unpaid medical bills will soon no longer appear on credit reports. The bureau predicts the removal of $49 million in medical debt from 15 million Americans as a result of this change, which will take effect later this winter. They further estimate that removing medical debt from credit reports will increase the credit scores for millions of families by 20 points on average.

Still, there remains fear and uncertainty around the fate of low-income insurance options such as Medicaid, which covered 20.4 million people in 2024, under the incoming federal administration. There is also concern nationally that the next president will attempt to overturn EMTALA, the law stating that anyone can access emergency services regardless of their ability to pay.

There are no easy answers to reducing medical costs in the United States. Future editions of this column will unpack the unseen costs of a medical visit and will address alternatives. In the meantime, the financial assistance office at Jefferson Healthcare is available for those seeking guidance on paying medical bills incurred through their health system. Another proactive measure that people in Jefferson County can take is to sign up for helicopter insurance: a link to Airlift Northwest’s membership application is here, and the sign-up link for Life Flight Network is here, each costing under $100/year. There are also paper applications available for both air ambulance services at any of our local fire stations.